Bitcoin mining is the process that is done by solving complex cryptographic hash puzzles to verify blocks of transactions that are updated on the decentralized blockchain ledger.

Each transfer on the Bitcoin network is validated and written into a block, which is then added to a single “chain” or blockchain. The essence of mining is to calculate (= create) this chain on the special equipment. That is what miners do.

Thereby, each block includes:

- the header hash of the previous block

- transaction hash

- random number

The mining consists of calculating the hash — the output — of the block header, the transaction and the number in the blockchain.

When a new block is created, the miner is rewarded with a certain number of Bitcoins.

Okay, it’s clear. But what about the hardware?

To begin with, we are bringing a simple truth: the more interest in Bitcoin, the harder it is to mine and the higher the value of the coin. This directly affects on development of ways to mine BTC.

The evolution of Bitcoin mining has gone through the following steps:

- central processing units (CPU) mining

- graphic processing units (GPU) mining

- field-programmable gate array (FPGA) mining

- ASIC miners

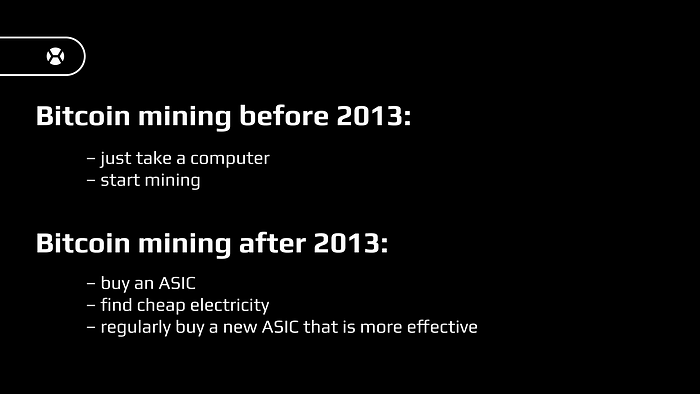

When Bitcoin’s creator Satoshi Nakamoto created the cryptocurrency in 2009, mining was not particularly popular. In the early days of BTC, mining was simple and was done using an ordinary computer processor.

The cryptocurrency gained popularity by November 2013. And just from 2012 to 2013, the difficulty of mining BTC increased 1,134 times!

As a result, mining the first cryptocurrency using CPU, GPU or chips became much more difficult.

The era of ASICs has begunThis opportunity was grasped by the Avalon company which introduced the Avalon ASIC for the first time. This machine was capable of mining Bitcoin at a much higher hashrate than traditional computers. And it quickly became a main device for major miners.

The competition was getting more intense, manufacturers were contending to see who would produce the most powerful and efficient ASIC. By 2014, miners were already using machines that were 100 times more powerful than the original Avalon ASIC.

But the next major evolution of ASIC miners happened in 2016 with the arrival of Bitmain’s Antminer S9. Bitmain had been “breaking in” with their designs before, for example, with their Antminer S7. But the S7 was 4.73 TH/s, that is 2.8 times lower than the new at the time S9.

The machine was much more efficient than previous ASIC miners, because its power consumption was lower and it mined more Bitcoins. The Antminer S9 remained the most popular ASIC for several years until it was eventually replaced by even more powerful machines.

The S9 helped Bitmain to establish their company as the manufacturer of the best Bitcoin (and not only Bitcoin 🙂 ) mining ASICs.

Today, ASIC miners have progressed to the point where the machines are mining multiple coins, using the same hashing algorithm. For example, Antminer S19 Pro can mine Bitcoin (BTC) and BitcoinCash (BCH). ASICs’ computer power allows only to mine one certain coin at a certain period of time. Please, keep in mind that you can’t mine different type of coins simultaneously.

Also ASICs today are much more energy efficient than earlier models. The latest ASIC miners can mine Bitcoin at over 100 terahashes per second. And the challenge for hardware manufacturers today is to balance power and energy consumption to justify the cost of electricity by the mined Bitcoins.

The best ASICs for Bitcoin mining in 2023

The best ASICs for Bitcoin mining in 2023

It is better to buy ASICs with high output but relatively low power consumption. This will balance the cost of electricity with the income that the machine will bring.

The best ASICs for Bitcoin mining in 2023 are:

- Bitmain Antminer S19 XP 134T

- Bitmain Antminer S19 Pro 110T

- Bitmain Antminer S19j Pro 104T

- MicroBT WhatsMiner M50 120T

- MicroBT WhatsMiner M30S 90T

These ASICs have a good price to their efficiency. At the same time, your spendings on electricity will be justified: the machine will bring BTC, so that you can not only cover the costs, but also make Bitcoin in profit. Electricity is an important point in mining in general.

Mining machines consume from 0.8 kWh and not every machine starts mining in profit in the first days. Therefore, use those asics that will get as much Bitcoin as is enough to cover your electricity fee and still give you a profit.

Another way to mine Bitcoin without buying an expensive ASICIn 2023 it is harder and more expensive to start Bitcoin mining than before. ASICs’ prices start from $2000 at the current BTC rate. But despite the relatively high cost of the machines, you can start mining Bitcoin in 2023 with a small investment.

Group mining farm allows you to buy a share of a crypto-farm with ASIC miners from $30. You get a personal account where you see the income and expenses of the whole farm — profits are expenses, according to your share.

So Group Mining Farm is an another way to mine Bitcoin without buying an expensive ASIC. You pay less, get into mining easier and get pure Bitcoin.

ConclusionThus, ASIC miners have become an important factor in the development of Bitcoin mining. The machines have undergone a long way of modernization and have evolved from relatively simple devices to powerful machines that are capable of mining Bitcoin from the very first days. At the same time, the market is also changing, creating new ways to make it easier to get into mining.