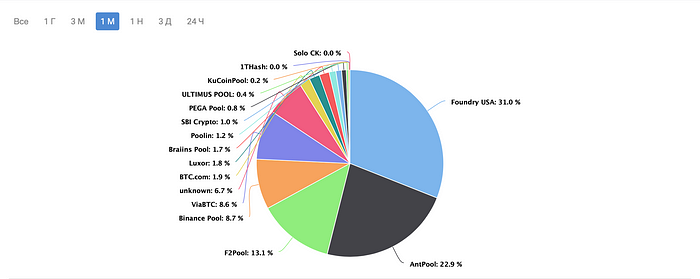

The vast majority of people who mine Bitcoin do so through pools, such as AntPool, Foundry USA, or F2Pool. When mining on your own, the chances of finding a block are virtually zero. A pool, thanks to its huge hashrate, finds a lot of blocks — and shares them among all the members.

Some users run big mining rigs, while others have only one ASIC. Their contributions aren’t equal, and pools use different ways to divide the rewards according to effort.

In mining pools, a share is a potential solution to a cryptographic puzzle (the block hash) that a miner sends to the pool operator. The number of solutions that an ASIC can generate in a second is the hashrate: for example, a 10 GH/s ASIC can send 10 billion hashes (shares) per second. With the PPS reward method, a miner gets paid for every share.

Features and advantages

- Stable income: you get paid for all the work you do no matter how many blocks the pool actually finds.

- Pools can’t cheat, because rewards are paid out daily and the number of submitted shares is known.

Disadvantages and risks

- Rewards don’t include transaction fees (e.g. transaction fees from minting Bitcoin Ordinals and BRC-20, which can be as high as the block reward).

- Even if your share turns out to be the right block solution, you don’t get any extra reward.

- PPS pool fees are usually higher, because this method is riskier for the pool

- Most smaller pools don’t offer PPS.

In PPS+, you get paid for every share you send like in PPS, but you also receive some of the transaction fees.

Features and advantages

- Very close FPPS (Full Pay Per Share): the difference is that with PPS+, you get a share of the actual transaction fees earned by the pool, while FPPS includes a share of the expected transaction fees over a period.

- Helps you take advantage of transaction fee increases when blockchain activity is high;

- Transaction fee rewards are paid only when the pool finds a block.

Disadvantages and risks

- PPS+ is actually a good choice for most miners, especially when the coin generates reasonable transaction fees. For example, in May 2023 BTC fees exceeded the block reward for the first time, benefiting those who mine on PPS+ or FPPS.

In PPLNS, the pool sets a number (N) of shares before a correct block hash is found: e.g. 20,000 or 50,000. As soon as the pool finds a block, it calculates the percentage of each user’s shares in the last N shares sent by all the members.

For example, if N=50,000, and you sent 500 out of the last 50,000 before a BTC block was found, your share of the block reward (6.25 BTC) is 500/50,000=1%, or 0.0625 BTC.

Features and advantages

- Transaction fees are often included in a PPLNS payout;

- N is adjusted based on mining difficulty;

- Pool fees can be as low as 0%;

- Good for miners with high hashrates;

- Gives an advantage to miners that are always online and don’t switch pools.

Disadvantages and risks

- You get rewarded only when the pool finds a block → income is less predictable compared to PPS.

- Over short periods, rewards heavily depend on the pool’s luck.

Reward calculation methods

- PPS: rewards depend only on your miner’s productivity.

- PPS+: miner’s productivity (number of shares) + pool luck (tx fees for found blocks).

- PPLNS: rewards depend on the user’s contribution and the pool’s luck.

Variability of payouts

- PPS: small but very regular and predictable payouts (every day) .

- PPS+: regular and higher than for PPS.

- PPLNS: high but unpredictable payouts (become predictable over longer periods).

Risks involved

- PPS: missing out on a lot of gains because of high pool fees and no tx fee payments.

- PPS+: this method offers a good risk and return balance, but for older ASICs mining BTC, it can still take a long time to reach the minimum payout threshold.

- PPLNS: in smaller pools, you can wait for a long time before you get paid anything. If your miner accidentally disconnects before a block is found, you won’t earn anything at all.

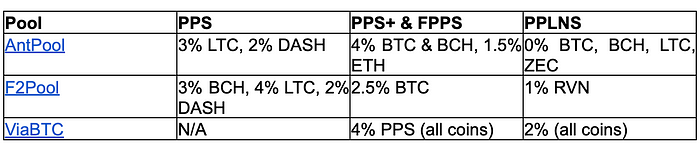

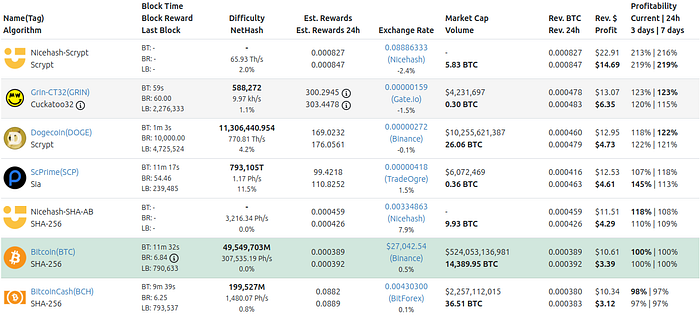

Mining pool fees comparison

Each mining pool charges different fees depending on the reward method and coin.

The table will give you a rough idea for three large pools.

Impact of fees on miner profitability

Pool fees are just one of many factors that influence mining earnings.

It won’t make much difference in the long run if you pay 2% or 2.5% of your rewards to the pool.

What really matters is the reward method, which coin you mine, your ASIC or GPU model,

and the pool’s network share.

1. Mining hardware and hashrate.

If you have a strong ASIC for Bitcoin mining (SHA-256 algorithm), as well as a stable internet connection,

then look for PPS+ or PPLNS. If your hashrate is low,

check the minimum payout amount and estimate how long it will take you to accumulate that amount.

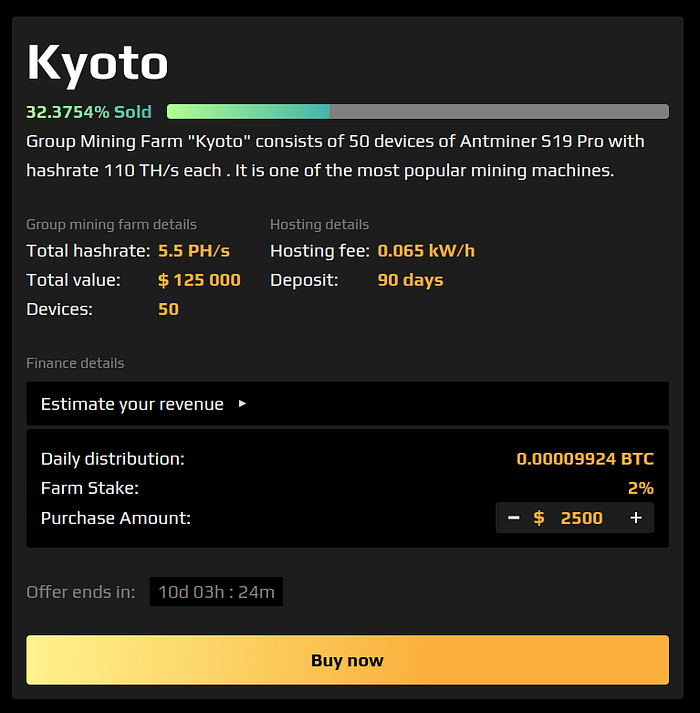

If you’re not ready to invest in an expensive ASIC, consider renting ASIC capacity on a group mining platform like XIVE . Our offers start from just $30 for a stake in our 5.5 Ph/s mining farm, and you won’t have to worry about hardware maintenance, switching between coins, etc.

2. Stability of income and risk tolerance. PPLNS is the riskiest and works well only with larger pools. If you prioritize stable passive income, go for PPS+.

3. Pool size and network share. When you join a big pool, you promote network centralization. On the other hand, such pools have more statistics, reviews etc. A lot of miners usually means reliability. In terms of earnings, pools with high hashrates find more blocks, so with PPLNS especially you can get to the minimum payout amount faster.

Solo mining vs pool miningThe biggest advantage of mining solo is that you get all the reward for yourself if you mine alone.

The problem is that mining Bitcoin on your own is basically impossible: you’ll never find a block.

However, it is possible to mine smaller PoW coins on your own: Ravencoin, Zano, Beam, etc. You can do it with a GPU, rather than an ASIC.

On the other hand, mining with a pool gives you a far more stable income and access to block rewards earned by other pool members.

Ultimately you should decide based on your individual circumstances:

- Are you prepared to mine a small, volatile coin that has a low difficulty and little utility?

- Are there currently profitable PoW coins that can be mined with your hardware outside of a pool?

- Does your hardware support the most profitable algorithm — and do you know how to switch between coins?

If the answer to all of these questions is “yes”, you can try solo mining. Otherwise, look for a reliable pool with PPS+ or try group mining with XIVE .

Additional considerations for choosing a mining poolApart from the reward calculation method, fees, and network share, there are a few more things you should consider.

- Proportional mining pool vs. PPS and PPS+. This is yet another reward scheme. Shares are calculated as in PPS, but you receive a payout only when a block is found. The block reward is distributed according to each miner’s accumulated number of shares.

- Reputation and track record of the pool. Do read reviews and check pool stats before joining. Some pools suffer from a lot of cheating miners, or even fall prey to hackers, and you can lose money because of that.

- Pool infrastructure and support. If something goes wrong with your connection to the pool and you stop receiving shares, you want to be able to contact human support immediately.

Before you even buy an ASIC, you need to do two things:

- understand the key differences of PPS vs PPLNS and PPS+;

- evaluate your personal preferences and risk tolerance. Ask yourself questions like these:

- Are you ready to wait longer to get a higher payout?

- Can you stay loyal to a pool for weeks without pool-hopping?

- Can you afford powerful enough hardware?

For example, for risk-averse miners PPS+ BTC mining works better than PPLNS, as payouts are very regular. But a low-end ASIC can never reach breakeven with this method, because the rewards will be too low. A remote solution like XIVE group mining can yield higher earnings than buying hardware.

When choosing a mining pool reward method, you have to make an informed decision. Only this way can you maximize mining profitability and success.

All information provided in this post is for informational purposes only and is not an investment recommendation guaranteeing future earnings. Cryptocurrency mining profitability depends on a variety of factors, including but not limited to: cryptocurrency market volatility, market prices of mining devices, electricity expenses, changes in regulation.